Unlock Why Cincinnati Surprising Surge in Q3 2024 Beat the National Average

Midwest Rental Markets Holding Strong

The Midwest rental market continues to defy national trends, maintaining steady rent growth while Sunbelt cities experience steep declines. We’ve been through many cycles in the Midwest markets over the years and have seen this pattern before. In fact, from our experience, these markets have proven to be counter-cyclical during broader downturns across the country.

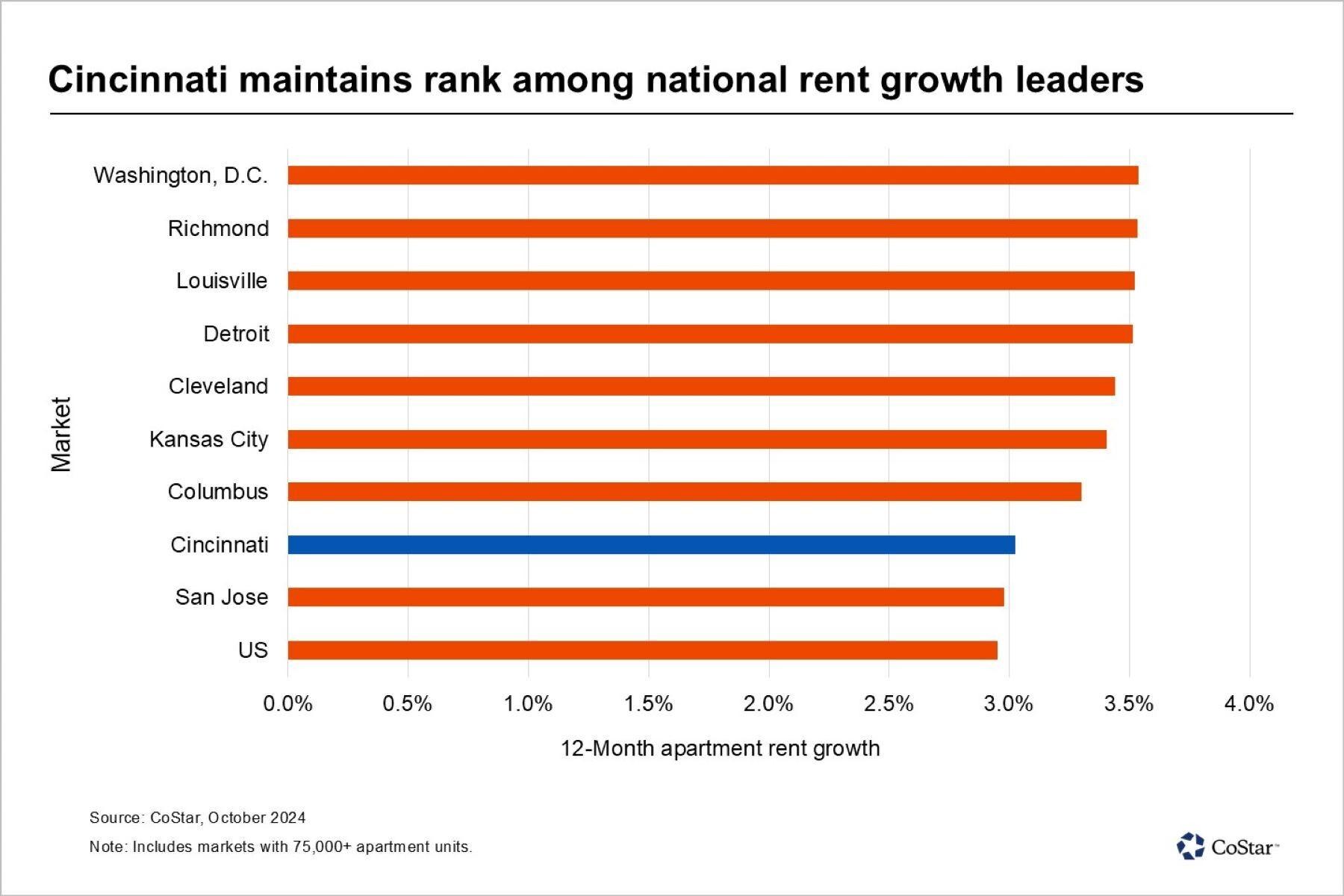

Cincinnati, in particular, has emerged as a leader in Q3 2024 rent growth. Bolstered by limited new supply and stable demand.

According to CoStar’s latest data, rent growth in Cincinnati reached 3% in Q3 2024. This significantly outperformed the national average of 1.1%. We can confirm strong rent performance all year in Cincinnati, with rents growing by at least 3% on renewals, and by high single digits in some cases on our new leases.

As of October, multifamily vacancy in Cincinnati stood at 6.6%, compared to the national rate of 7.8%. This resilience highlights the city’s ability to sustain rent appreciation despite broader economic shifts.

Limited New Supply Sustains Rent Growth

National apartment completions in 2024 are set to reach record highs. However, Cincinnati has managed to maintain balance with new supply still below 4% of total inventory. This controlled pipeline has helped keep vacancy rates in line with pre-pandemic levels, ensuring landlords can continue achieving rent increases on both renewals and new leases.

For example, Northwest Cincinnati and North Hamilton, which together account for 21% of the city’s rental inventory, ended Q3 with 4% rent growth. New apartment deliveries in Northwest Cincinnati (including suburbs along I-75) reached record levels this year—but notably, these represent the first new units in nearly a decade. Meanwhile, North Hamilton, an area in which PRPI has invested for nearly 20 years, saw vacancies decline to 3.5%, well below Cincinnati’s citywide 6.7% rate, per CoStar data.

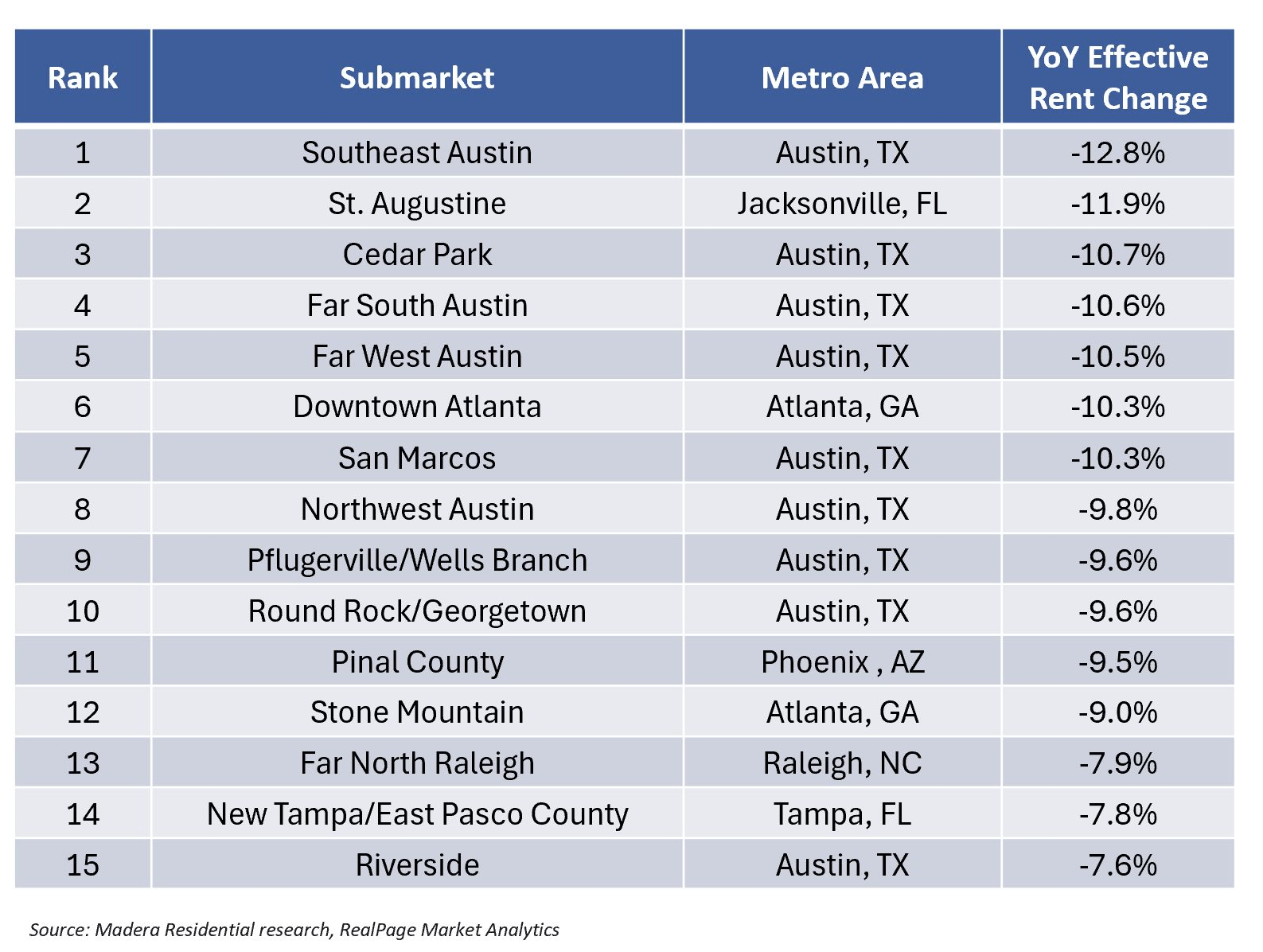

Sunbelt Markets Face Declining Rent Growth

In contrast, several Sunbelt metros are struggling to absorb record-high deliveries. Austin, TX, for example, posted the nation’s steepest rent declines, with Southeast Austin experiencing a 12.8% drop. In fact, of the 15 worst-performing rental markets in the U.S., nine are in Austin.

These figures reinforce the Midwest’s countercyclical nature—when Sunbelt markets face oversupply, Midwestern cities like Cincinnati often see demand remain stable or even rise. As a result, multifamily investors should take note: Cincinnati may not offer Texas-sized appreciation, but it does provide steady, predictable returns in a volatile market.

Cincinnati’s Downtown Revival Continues

Cincinnati’s downtown is also seeing renewed interest (which we also have exposure to), thanks to an authentic live-work-play environment. PRPI’s internal research indicates that 2,618 new apartment units are either planned or under construction in the urban core. Notably, Cincinnati leads the nation in office-to-residential conversions, further enhancing the downtown rental landscape.

Despite the increased inventory, PRPI has recorded 3% rent growth on renewals downtown—outpacing CoStar’s citywide 2% growth figure. Meanwhile, occupancy levels within our portfolio remain strong, even as CoStar characterizes demand elsewhere in the city as muted.

A Promising Future for Cincinnati’s Rental Market

Looking ahead, CoStar forecasts continued rent growth in Cincinnati as elevated interest rates slow new development. The pace of apartment completions is expected to decline over the next 12 to 18 months, keeping vacancy levels low and rental rates rising.

For investors, Cincinnati offers an attractive alternative to oversaturated markets. With new supply constrained and demand holding steady, the city is well-positioned to deliver above-market returns in the near future.