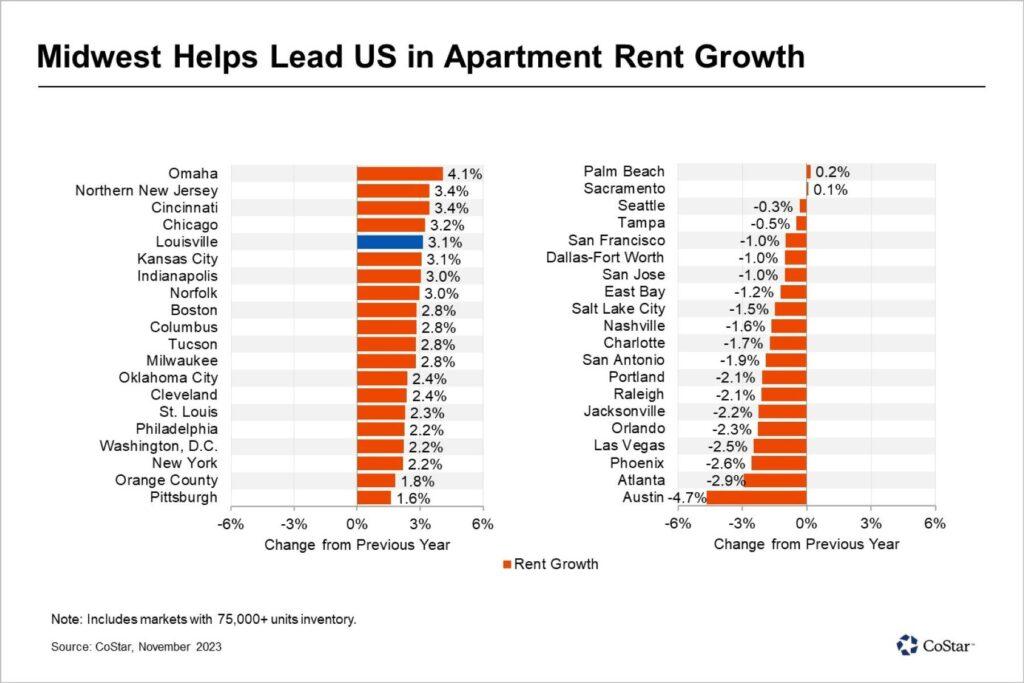

Cincinnati Leads Nationwide Multifamily Rent Growth

Cincinnati has emerged as one of the leading nationwide markets for rent growth — not just in the Midwest, but in the entire country. Louisville, Kentucky, was also a strong performer.

Rents in Louisville and Cincinnati grew be about 3.1% and 3.4%, respectively, as of the third quarter and these two markets ranked among the top five markets in the United States for rent growth.

The Midwest region has topped the charts for multifamily rent growth since the start of 2023, and third-quarter data shows the region continues to post healthy gains.

Several factors, including affordability, balanced population growth and relatively limited construction completions, compared with high-growth Southeast and Southwest markets, support steady rent growth throughout the Midwest.

Meanwhile, completions over the past 12 months in Louisville were near record levels and totaled around 2,500 units, slightly above the average over the same period over the past five years. Despite the accelerated pace of completions, vacancies in Louisville rose just 50 basis points year over year to 6.9%, compared with a 130-basis-point increase at the national level, where it is 7.2%.

Strong demand is supporting healthy market conditions in Louisville and Cincinnati, and this is allowing landlords to keep pushing rents at a steady pace, even as occupancy softens in response to the new inventory. In Louisville, close to 1,900 units were newly occupied over the previous 9 months, which represents 2.1% of total market inventory (compared with 1.3% for the national market). Annual demand in Louisville now is at the highest level since early 2022.

One of Louisville’s larger concentrations of multifamily stock is seeing particularly strong rent growth. In South Jefferson County, completions have been limited over recent quarters, and vacancies are about 100 basis points below the market rate. Tight market conditions support above-average gains, which sit at 5.8%.

Affordability in these two markets, along with markets like Columbus, Indianapolis and Dayton, will likely keep rent growth healthy in the quarters ahead. Average asking rents in these cities is still 33% below the national average, despite the recent run up, according to CoStar