Cincinnati Rent Growth 2023: What’s Now Driving The Country’s Strongest Surge In A Year

Cincinnati Rents Surge in Q2 2023 as Other Markets Cool

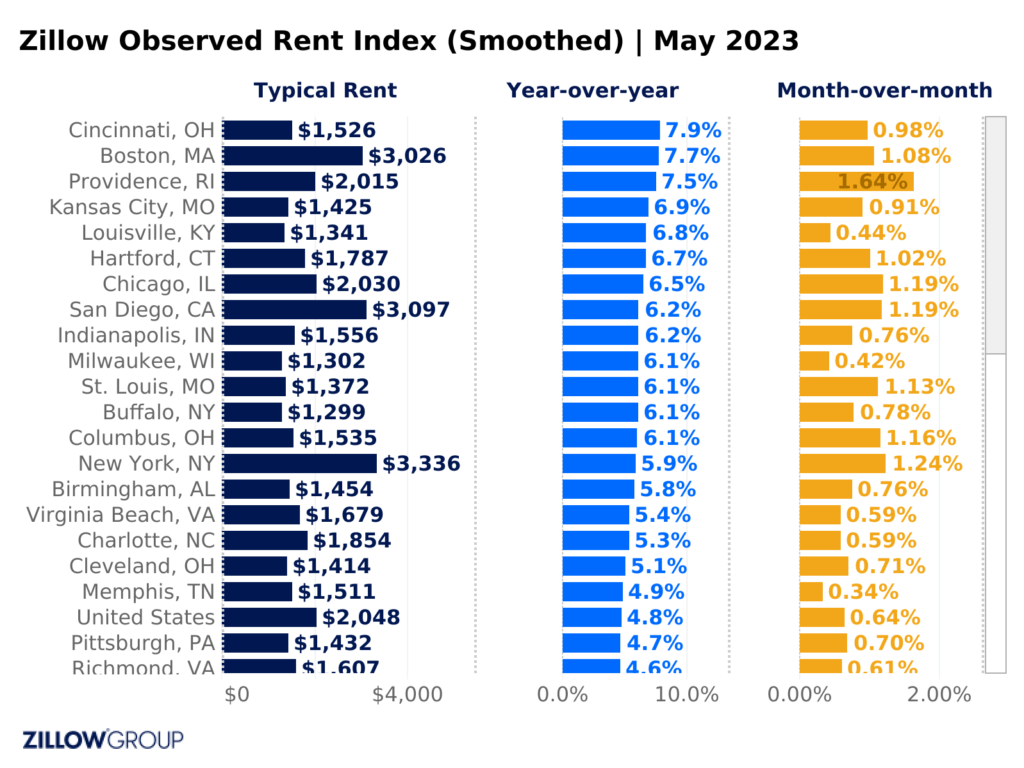

While nationwide apartment rent growth is slowing, Cincinnati Rent Growth 2023 has defied the trend. According to Zillow, Cincinnati experienced 7.9% year-over-year rent growth as of May 2023—the highest increase of any market in the U.S.

Cincinnati’s relative affordability, walkability and strong demand continue to attract renters. Meanwhile, cities in the Sunbelt struggle with oversupply, rising costs and weakening investor confidence.

Other top-performing cities, such as Boston, Providence, Kansas City, and Louisville, also reported strong annual rent increases, reinforcing the Midwest and Northeast’s dominance in rent growth.

Sunbelt Markets Face Growing Pressures

Unlike Cincinnati, Sunbelt investors are facing increasing headwinds. Many of these markets saw aggressive rent growth projections that are now failing to materialize.

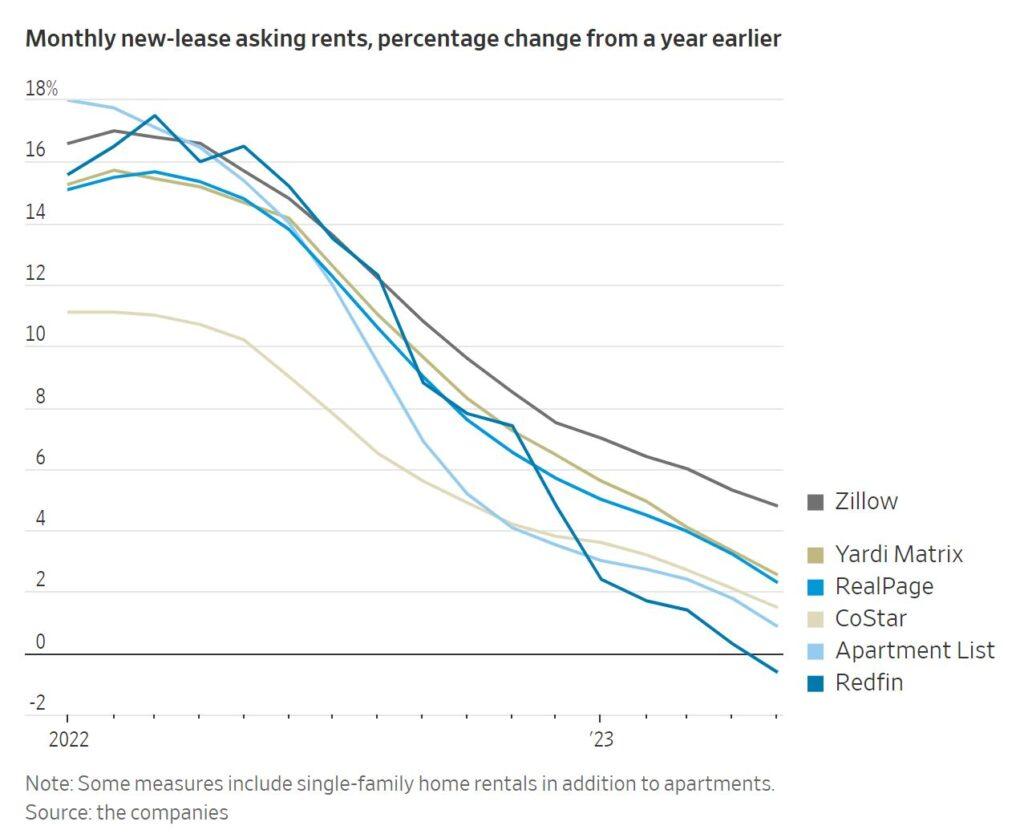

According to the Wall Street Journal, nationwide apartment rent growth is slowing at the fastest rate since the Great Financial Crisis. Yet Cincinnati doesn’t seem to know this. In the Sunbelt, where many wagered on rent growth growing to the sky in perpetuity, the magnitude of the slowdown has taken many investors by surprise. According to the WSJ, many of these investors share similar circumstances:

“[they] took out large, floating rate loans to buy buildings where they thought they would be able to keep raising rents. They are facing a softer market, falling property values and interest rates that have roughly doubled from early last year.“

https://www.wsj.com/articles/renters-are-about-to-get-the-upper-hand-f6387df4

However, as interest rates doubled from early last year, these investors are now confronting:

- Falling property values

- Higher financing costs

- Rising property taxes and insurance premiums

- Short-term loan maturities that are difficult to refinance

This list of difficulties in the Sunbelt includes increasing property taxes and insurance costs on properties bought at the peak of the market with short-term loan maturities that cannot be refinanced.

This combination has created a challenging environment, particularly in high-growth Sunbelt markets like Austin, Phoenix, and Las Vegas, where rents are stagnant or even declining.

Cincinnati Rent Growth 2023 Market Strength Explained

Cincinnati continues to thrive for several reasons:

- Affordable rents: Rent levels in Cincinnati remain 50% lower than in high-cost metros like Boston, San Diego, and New York.

- Sustainable demand: Unlike the Sunbelt, Cincinnati has not seen an overwhelming flood of new supply, keeping vacancies low.

- Urban appeal: Cincinnati offers a walkable, live-work-play environment, which attracts both young professionals and relocating renters.

With these advantages, Cincinnati continues to outperform even larger, more expensive cities across the country.

The Cities Leading and Lagging in Rent Growth

Zillow’s latest data highlights the stark contrast between growing and struggling rental markets:

Top Rent Growth Markets (YoY Increase as of May 2023):

- Cincinnati – 7.9%

- Boston – 6.8%

- Providence – 6.5%

- Kansas City – 6.3%

- Louisville – 6.1%

Slowest Rent Growth Markets (YoY Change as of May 2023):

- Las Vegas – (-1.4%)

- Phoenix – (+0.4%)

- Austin – (+0.8%)

- Salt Lake City – (+1.5%)

- San Francisco – (+1.7%)

The fastest-growing markets remain concentrated in the Midwest and Northeast, while Sunbelt metros face a cooling rental landscape.

Cincinnati Rent Growth 2023: A Favorable Outlook for Investors

As the Sunbelt struggles with oversupply and financial pressures, Cincinnati’s fundamentals remain strong. The city’s affordable rental prices, stable demand, and high-quality urban environment position it for continued rent growth and long-term investor appeal.

With no signs of oversupply, Cincinnati is likely to maintain its momentum, making it an attractive option for investors looking for resilient, high-performing multifamily markets.

If you want to dive deeper into our investment strategy, click here.