Why Invest in Multifamily Real Estate?

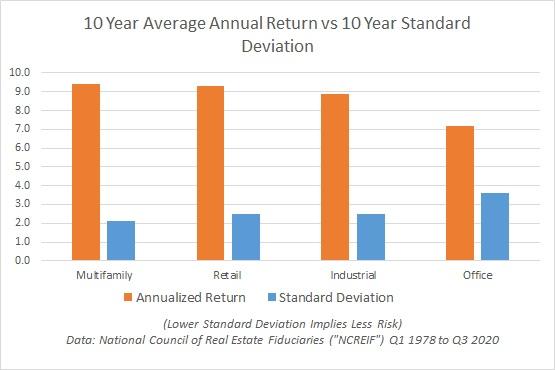

Historically, multifamily real estate has been a stable asset class with attractive returns and low volatility -- but we have a nationwide housing shortage.

"The multifamily sector has generally outperformed the other major CRE sectors. At the foundation of multifamily sector performance is a stable and essential asset that benefits from younger generations renting longer and increasing numbers of empty nesters downsizing to rental housing. With short-term leases (inflation hedges), diversified tenancies, lower tenant improvement and capex requirements, high NOI-to-cash flow margins, and a deep capital pool due to support from Freddie Mac and Fannie Mae, multifamily continues to be an attractive asset class."

Dr. Peter Linneman; The Golden Age of Multifamily Investing

Fannie Mae, Freddie Mac, and HUD provide critical, ongoing sources of backstop liquidity for multifamily investments in good times and bad.

In Q3 of 2023, government sponsored agency portfolio lenders and agency sponsored MBS comprised the largest share of total multifamily debt outstanding at $986 billion (48%). This was followed by banks and thrifts with $606 billion (30%), life insurance companies with $223 billion (11%), state and local government with $115 billion (6%), and CMBS, CDO and other ABS issues holding $67 billion (3%).

Unlike other asset classes, such as office and retail, these agency lenders provide a critical source of stability and liquidity for investors in multifamily real estate.

Shortages of multifamily housing will persist through 2035, if not beyond, according to Freddie Mac and the Harvard Joint Center for Housing Studies.

The suppply of new housing in the United States has not yet recovered from the damage caused by the Great Financial Crisis, when new construction ground to a halt. Following the crisis, construction of multifamily housing did eventually increase, but this new construction consisted primarily higher-end rental housing. Overall, according to the Brookings Institution, the stock of affordable and workforce housing has actually declined since the crisis1.

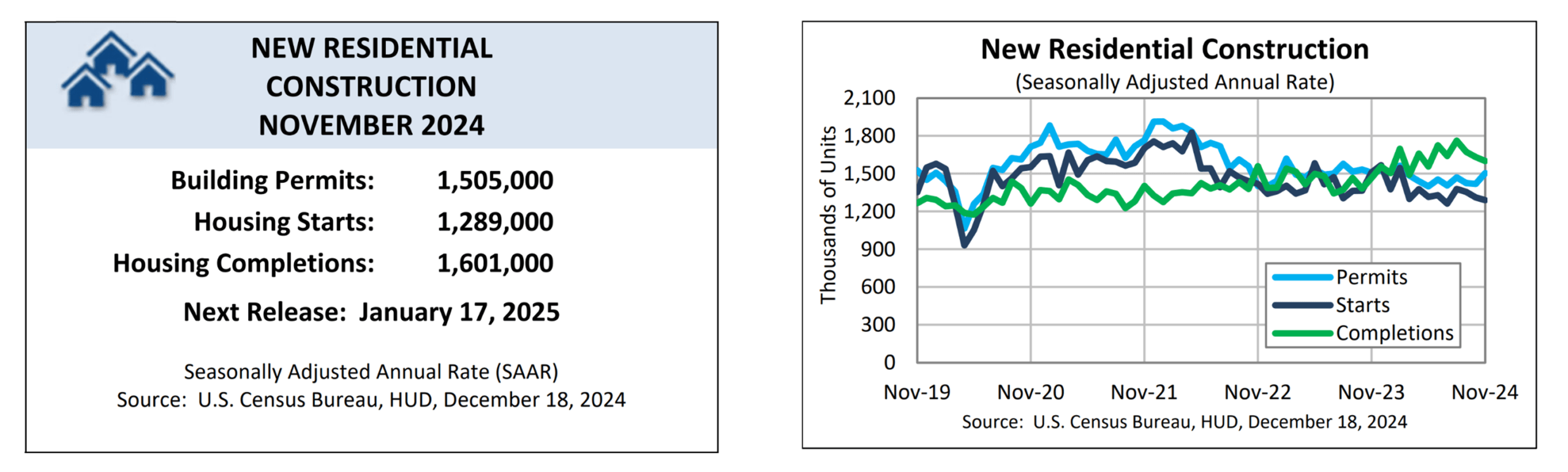

In total, Freddie Mac estimates that the current rate of housing completions is approximately 1.601 million housing units per year, vs. demand of approximately 1.62 million housing units per year2. However, this 200,000 deficit does not tell nearly the full story, which is that the Great Financial Crisis led to nearly a decade of underbuilding, and this insufficient level of completions, even if increased significantly, would not be nearly enough to overcome over a decade of undersupply, according to recent data from the Census Bureau and HUD3.

The issues around creating additional housing units to meet this demand cannot be easily solved, according to Freddie Mac4. These issues include:

- The cost of land and materials, which have increased significantly5

- A shortage of skilled labor in the construction trades

- Widespread opposition to new developments near homes and communities by residents—so-called NIMBYism

The result has been nearly a decade of underbuilding relative to demand, especially as it relates to workforce rental housing, and most of the forces that caused this underbuilding remain. As a result, the housing supply in the United States is well short of what is required, and it will remain so for the foreseeable future.

Actual demand for housing has been even greater than Freddie Mac's estimate

Three household surveys recently released by the Census Bureau all showed nearly unprecedented levels of household growth from 2019 through 2021 -- far higher than Freddie Mac's 2018 estimate. The American Community Survey (ACS), Housing Vacancy Survey (CPS/HVS), and American Housing Survey (AHS) each reported that annual household growth between 2019 and 2021 averaged between 2.0 million and 2.4 million new households per year, which is clearly far higher than Freddie Mac's projected baseline growth rate of 1.62 million new households per year, and far in excess the current 1.447M annual rate of housing unit completions.

This indicates that the U.S. housing market was actually undersupplied by approximately 600,000 to 1,000,000 housing units per year from 2019 to 20217. This even larger supply deficit will be even harder to overcome, particularly as it relates to workforce rental housing, and it will likely push the current supply/demand imbalance well beyond 2035. Significantly, household growth rose most rapidly among those aged 25-34 and 35-44, with the former age cohort having the highest propensity to rent than any other age cohort.

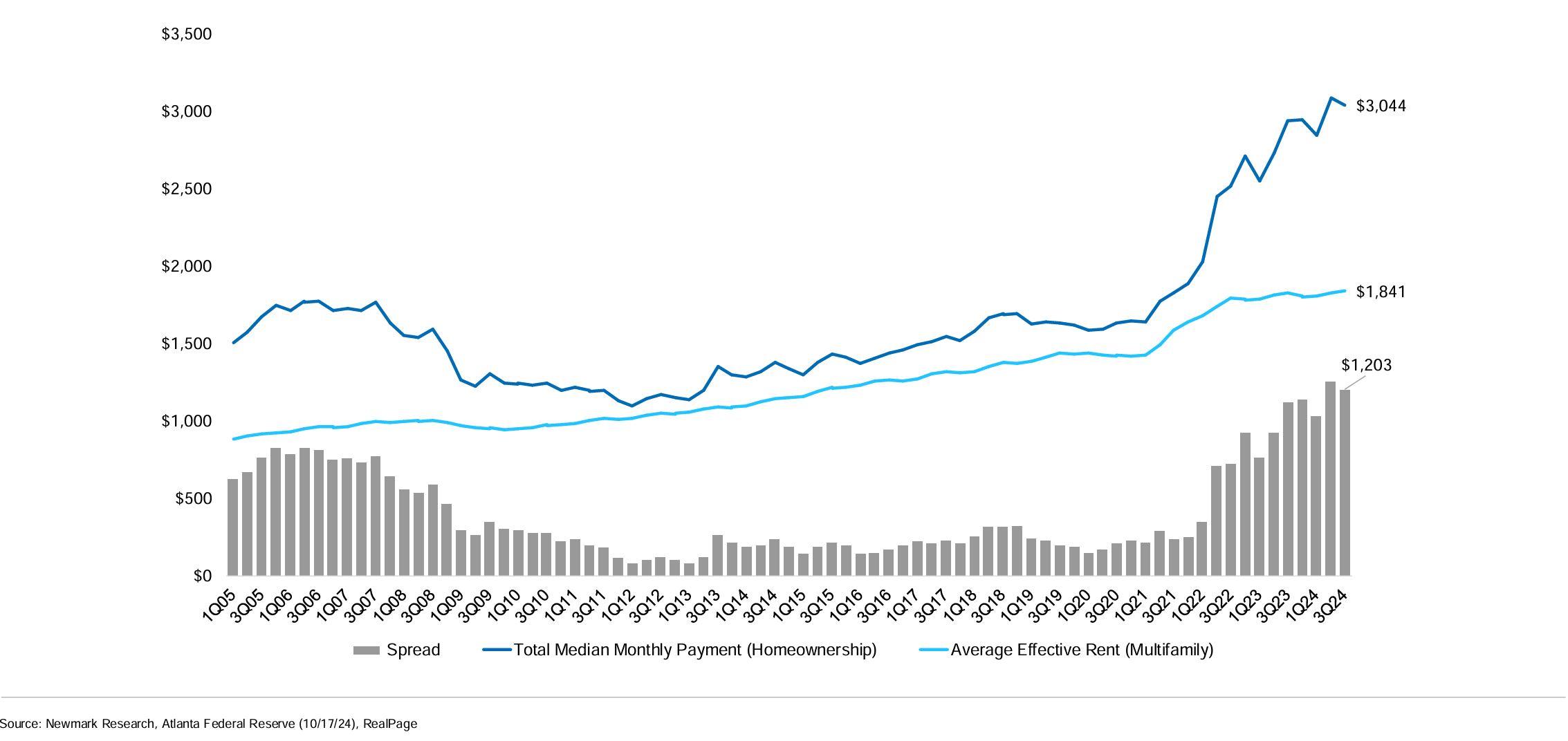

The rising cost of homeownership also favors rentals

In addition to stronger than anticipated household growth, much of it among millenials, the rising cost of homeownership is also supporting demand for rentals as housing prices and mortgage rates rise in tandem. In 2022, CBRE calculated that the gap between the cost of homeownership and renting rose to 57% (meaning the cost of homeownership was 57% higher than the average monthly apartment rent, the widest cost gap on record5.

In Q3 2024, Newmark, using data from the Federal Reserve Bank of Atlanta, calculated that the spread between the cost of homeownership and the cost of renting grew to $1,203 in the third quarter of 2024, and the data showed that the gap between the cost of ownership vs the cost or renting has continued to increase. The main driver of higher homeownership costs is higher interest rates, but higher insurance premiums are also playing a role

Interest rate volatilty & hypersupply in certain markets are generating investor caution and in some cases, distress

The U.S Federal Reserve has increased the Fed Funds rate from nearly zero in early 2022 to approximately 5% in just 15 months, one of the fastest tightening cycles in history. This is causing investment property values to fall. (generally speaking, higher interest rates = lower valuations).

In addition, many new investors purchased assets at the top of the market in 2020 and 2021 using short-term, floating rate debt when interest rates were near zero and rent growth was peaking. Most of these investors purchased interest rate caps to guard against interest rate increases, but some did not. Even those who did purchase interest rate caps now find themselves struggling with weakening NOI, higher debt service costs and looming loan maturities from 3-year debt taken out at the top of the market in 2020 and 2021.

These mistakes were compounded by decisions to invest in markets were future hypersupply was obvious. In Phoenix, for example, new construction totals 34% of current inventory, and as a consequence rents in Phoenix have declined by 6% YOY, according to CoStar. We believe this Phoenix disclocation is temporary, but we prefer avoid this kind of volatility.

Due to the current market dynamics, many investors are expecting a correction, and they have pulled back from making new investments. Consequently, sales volume in the multifamily market is down by approximately 70% in 2023 over 2022, according to most brokers. 2024 sales volume is down 60% YTD vs 2022.

Where do we see opportunities?

In contrast to the negative rent growth in over supplied markets like Phoenix and Las Vegas, new supply in Indianapolis is just 4.2% of existing inventory, according to Costar, while new supply in Cincinnati is just 4.3% of existing inventory. Not surprisingly, Indianapolis and Cincinnati are now the #2 and #3 nationwide leaders in rent growth, coming in at 6.8% and 6.4%, respectively, just behind Omaha which was #1 with 7.3% rent growth.

Supply/demand relationships like this should be no surpise, and we see continued opportunities to buy and renovate existing workforce rental properties in Indianapolis and Cincinnati, as well as other Midwestern markets like Lexington and Louisville whose supply/demand fundamentals are in better balance and where healthy job growth is leading to steady demand for rental housing. In addition, these markets are often overlooked by institutional capital, and as a result they offer compelling opportunities to purchase quality assets in good locations with less competition and more advantageous pricing.

1 The Brookings Institution: Lessons from the financial crisis: The central importance of a sustainable, affordable and inclusive housing market. September 5, 2018

2 Freddie Mac: The Major Challenge of Inadequate U.S. Housing Supply. December 5, 2018

3 U.S. Census Bureau & HUD: New Residential Construction. August 16, 2023

4 Freddie Mac: The Major Challenge of Inadequate U.S. Housing Supply. December 5, 2018

5 NAHB: Higher Construction Material Costs. December 31, 2021

6 CBRE: U.S. Real Estate Market Outlook 2023 . December 22, 2022

7 Harvard Center for Joint Housing Studies: The Surge in Household Growth and What it Suggests About the Future of Housing Demand. January 17, 2023