Supply-Constrained Midwest Rentals: A Remarkable Surge in Rent Growth You Need to See Now

Midwest markets are gaining national attention in 2024—and for good reason. In a landscape dominated by headlines about oversupplied Sunbelt metros, supply-constrained Midwest rentals are quietly outperforming, driven by muted construction pipelines, resilient job growth, and a new wave of industrial and manufacturing developments. These supply-constrained Midwest rentals reflect a broader national shift in fundamentals and investor attention.

Why Supply-Constrained Midwest Rentals Are Rising While the Sunbelt Stalls

The Sunbelt’s once-booming apartment pipeline has now become a headwind. Markets like Phoenix and Charlotte, a flood of high-end, four- and five-star deliveries has pushed vacancy rates up and rent growth down. In fact, new deliveries in the Sunbelt have pushed the national supply average to its highest rate in years.

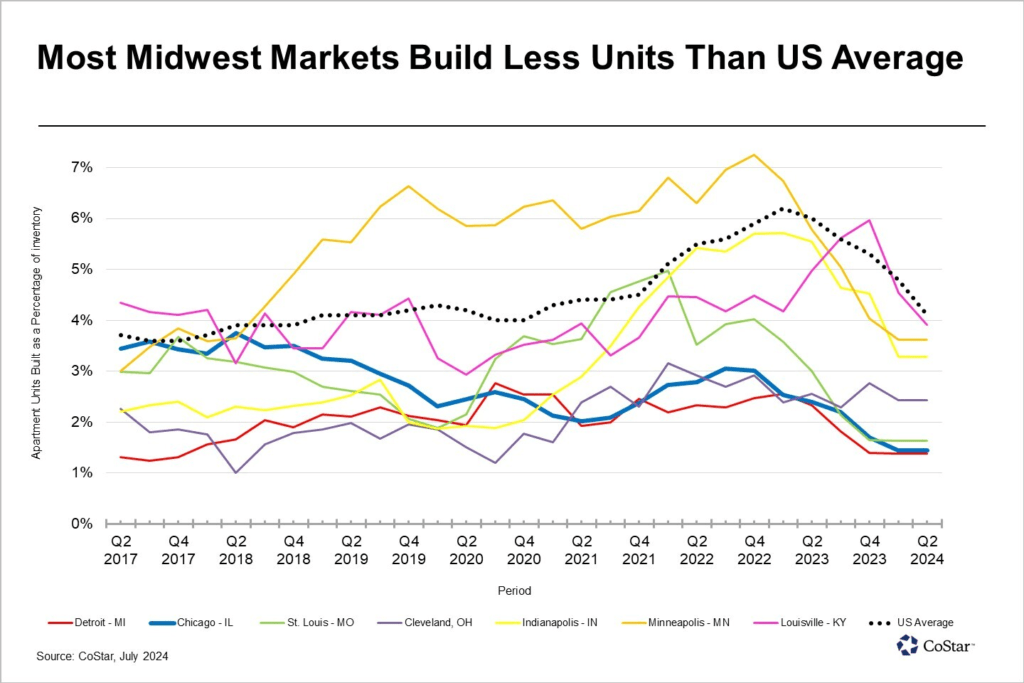

In contrast, supply-constrained Midwest rentals tell a different story. Most Midwest markets have delivered new apartments at a pace well below the national average over the past seven years. That restraint is now paying off.

Rent Growth Trends Show a Clear Divergence

Ten of the 11 largest Midwest markets—led by Louisville and Cleveland—posted year-over-year rent growth of 3% in early 2024. That’s nearly triple the national average of 1.1% and a stark contrast to the Sunbelt, where rents have fallen by -1% on average.

This trend reflects more than just cyclical momentum. It suggests a structural shift.

- Midwest markets are in better balance, where completions (supply) align with absorption (demand).

- Sunbelt markets are oversupplied, with a growing mismatch between new construction and demand.

In short, the Midwest is gaining ground—because it never overbuilt to begin with.

Demand Is Changing—and So Is the Narrative

Beyond construction trends, macroeconomic forces are adding fuel to the Midwest’s momentum. In-migration is no longer just a Sunbelt story. Several Midwest states are now beneficiaries of reshoring and federal incentives driving new manufacturing initiatives. From semiconductors to electric vehicle batteries and even electric air mobility, new job centers are taking shape in states like Ohio, Michigan, and Indiana.

These new economic anchors are turning supply-constrained Midwest rentals into long-term plays—not just temporary safe havens.

What This Means for Investors in Supply-Constrained Midwest Rentals

The narrative that the Midwest is “slow and steady” may need to be rewritten. In this cycle, restraint and fundamentals are producing outperformance. Midwest markets are:

- Benefiting from disciplined construction pipelines.

- Achieving rent growth with limited new inventory.

- Gaining relevance thanks to new demand drivers.

While other regions recalibrate from overbuilding, supply-constrained Midwest rentals could continue to lead the national rent growth race in 2024 and beyond.

Want to understand how PRPI identifies resilient opportunities in supply-constrained markets? Explore our approach and discover where we’re seeing outsized risk-adjusted returns.