Midwest Multifamily is Becoming An Even Better Bet in a Shifting Landscape

The multifamily investment landscape is evolving, and savvy investors are taking note. While concerns about rising construction and potential vacancy rate increases hang over the national market, one region is quietly emerging as an promising investment alternative: the Midwest.

Midwest Rent Growth Defies National Slowdown

Michael Gerrity, editor of The World Property Journal, reports that 2023 witnessed a surge in apartment construction, driving national vacancy rates above 5%. This also led to much slower rates of national rent growth. However, a closer look reveals a more nuanced regional picture. Indeed, the Midwest was one of only two regions (the other being the Northeast) to defy the national trend in slowing rent growth. In fact, the Midwest experienced positive year-over-year rent growth across all markets in Q4 2023.

- Midwest Rent Growth: 2.7% rent growth in the Midwest, and 2.4% growth in the Northeast. The Southeast, South Central, Mountain and Pacific regions all had negative rent growth.

- Midwest Vacancy Rates: Lower than the national average, with Madison boasting the lowest rate at 2.8%

Midwest Metros Appear Poised for Continued Success

This data show that the Midwest’s much more controlled construction pipeline has been well balanced with demand, while record new deliveries in in the Southwest and Southeast has led to negative rent growth in those regions. This is increasing the Midwest’s reputation for a more stable environment for investment, but now the region is also growing faster than than it has in many years.

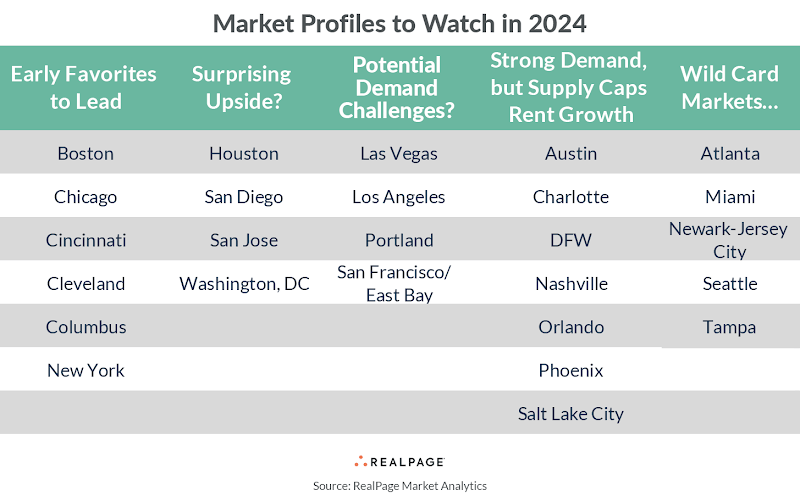

The Real Page chart shown below reinforces this sentiment and pinpoints several “early favorite” markets for 2024, with Midwest cities like Chicago, Columbus, and Cleveland expected to outperform due to their existing strong fundamentals – population growth combined with moderate new construction pipelines is driving high occupancy and healthy rent growth.

Demographic Shifts Are Fueling Midwest Opportunity

According to Bloomberg and analysis by Bank of America, high cost coastal cities like San Francisco are seeing increased rates of out migration, while less expensive Midwestern cities like Columbus are seeing in-migration. In fact, Columbus had the highest growing population out of any ‘big’ city in America in 2023, with a 1.1% population gain. Austin, TX was next.

Bank of America attributes the migration from the West to the Midwest and South to the lack of affordability in cities like Los Angeles and San Francisco. Bank of America says it is no coincidence that these two cities saw the two highest decreases in population in 2023.

“There’s a close relationship between a metropolitan area’s median mortgage payment and that area’s change of population last year”

Bloomberg, February 5, 2024

Bank of America’s analysis linking median mortgage payments to population change, suggests that the Midwest’s relative affordability should continue to support population growth, which should in turn fuel increased demand for housing in the Midwest.

There Are Multiple Advantages to Investing in the Midwest

- Affordability: Compared to coastal markets, the Midwest offers higher yields and currently more rent growth than sunbelt markets, as well as lower operating costs (especially in taxes and insurance).

- Stable markets: Midwest metros like Columbus and Cincinnati boast diverse economies with a strong, diverse base of employers, leading to lower unemployment rates and more consistent rates of growth.

- Growing demand: National demographic shifts favoring the Midwest are creating healthy demand for rental housing, while controlled construction pipelines suggest that Midwest will continue to generate attractive value-add investment opportunities.

While no investment is without risk, we believe that the Midwest multifamily market presents an attractive risk reward balance when compared to many other markets. Its combination of affordability, stability, and growing demand positions it as a good choice for investors seeking value and long-term growth potential.