A New Surge In The Midwest Job Growth Now Turns Heads as Cincinnati & Indy Boom

Not Just the Sunbelt Anymore

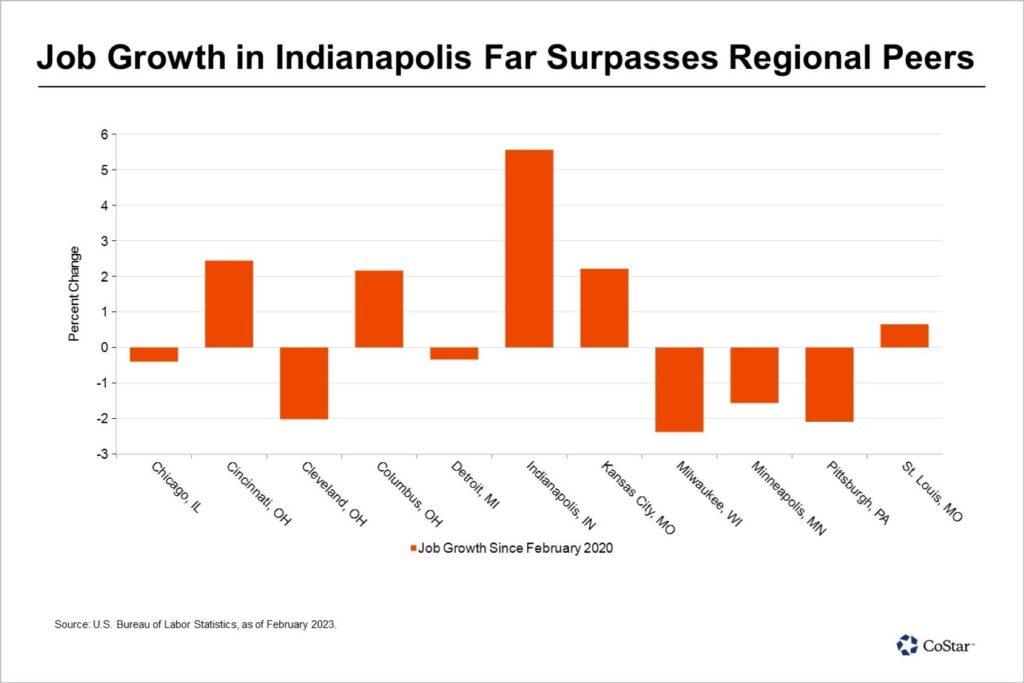

Sunbelt markets like Austin routinely dominate headlines about job growth. But if you dig into the latest post-COVID job numbers from the U.S. Bureau of Labor Statistics, the Midwest job growth is punching well above its weight, too.

In fact, two of our focus markets—Indianapolis and Cincinnati—are posting employment growth that outpaces both their regional peers and the national average.

- As of February 2023, Indianapolis employment sits more than 5% above its pre-pandemic levels (vs. 2% national growth).

- Cincinnati wasn’t far behind, second only to Indianapolis, with job growth that also beats the U.S. average.

These markets aren’t just recovering. They’re evolving—and fast.

What are Indianapolis’ and Cincinnati’s Superpowers?

1. Logistics and Transportation Strength

Both cities benefit from powerful concentrations in logistics and transportation.

Indianapolis:

- Home to the world’s second-largest FedEx Express hub.

- Regional headquarters for CSX, a freight and transportation giant.

- Employment in trade, transportation, and utilities is 10% above February 2020 levels—compared to just 4% nationally.

Cincinnati:

- Anchored by Amazon Air’s brand new $1.5 billion global freight hub at the Cincinnati/Northern Kentucky airport.

- Amazon plans to locate up to 100 Boeing 767 and 737 aircraft in the area across two hubs—one in Cincinnati, one in Wilmington, Ohio (50 miles northeast).

- As a result, Cincinnati’s trade, transportation, and utilities employment is almost 6% higher than pre-pandemic levels.

In short, these cities aren’t just participating in the logistics boom—they’re shaping it.

2. Corporate Headquarters and Professional Services

Indianapolis:

- A national leader in pharmaceuticals and healthcare.

- Global headquarters for Eli Lilly and Anthem Healthcare, plus North American HQ for Roche Diagnostics.

- Employment in this sector climbed 7% during 2022 alone.

The downstream effects are clear:

- Median household incomes are up almost 20% in Indianapolis since 2019, compared to 12% nationally.

- Indianapolis retail vacancy rates hit record lows late last year, and even with modest softening, still sit 70 bps below the U.S. benchmark at 3.5%.

Cincinnati:

- Currently home to seven Fortune 500 companies, including Kroger, Fifth Third, and Procter & Gamble.

- In 2024, when Boston-based GE finishes splitting into three firms, GE Aerospace—one of the world’s largest jet engine manufacturers—will join that list as a newly headquartered public company.

- Currently, GE employs approximately 9,000 Ohioans statewide, with most jobs concentrated in the Cincinnati/Dayton region.

- Professional and business services jobs have grown by almost 8% over pre-pandemic levels.

This breadth across industries creates resilience that few markets can match.

Midwest Job Growth: Why Affordability—and Reshoring—Matter More Than Ever

We began investing contrarian capital into the Midwest back in 2006, when most investors were still chasing sunbelt growth and dismissing the “Rustbelt” as irrelevant.

Today, that narrative is obsolete.

Here’s why:

- Indianapolis and Cincinnati feature historic urban cores and infrastructure assets that simply cannot be replicated.

- Even before COVID, trends like reshoring and onshoring were reshaping U.S. manufacturing.

- COVID and national security concerns have accelerated these efforts dramatically, especially in logistics and production hubs.

As a result, these markets are seeing steady, durable growth—without the overheated spikes (and crashes) that now characterize parts of the Sunbelt.

Affordability Advantage Remains Intact for Future Midwest Job Growth

Even as rents rise, Indianapolis and Cincinnati remain deeply affordable compared to national averages:

- In 2021, downtown Cincinnati rents grew 11.9% year-over-year, per RealPage Analytics.

- Despite that surge, rents remained roughly 30% below the national average.

In 2023, rent growth in Cincinnati and Indianapolis were still outperforming more popular markets, yet rents were still more affordable than the national average. Looking to 2024, both cities should continue to post outperformance in rent growth—yet still offer renters and employers a significant cost advantage.

Meanwhile, some Sunbelt investors who chased headline growth in 2020 and 2021 are now grappling with painful downside corrections. In contrast, the Midwest job growth story remains one of slow, steady, compounding gains.

If you’re interested in learn more about our investment strategy, click here.