See The Eye-Opening Surge: How Cincinnati is Actually Defying Expectations in Rent Growth in Q3 2024

Midwest Rent Growth Holds Strong in Q3 2024

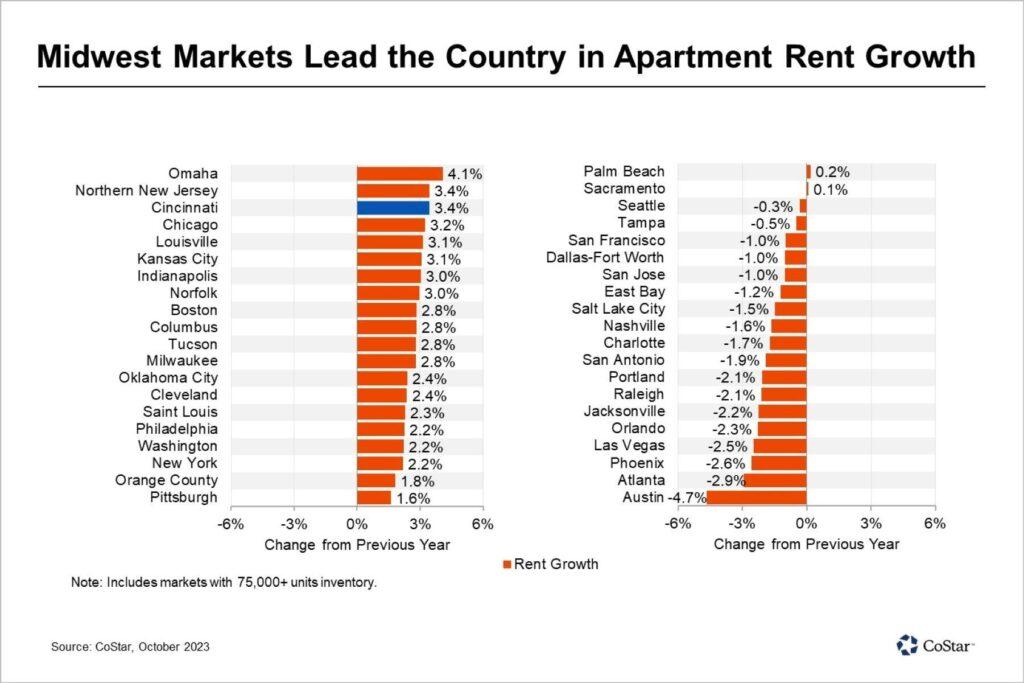

Since early 2023, Midwestern rental markets have consistently ranked among the nation’s top performers, posting steady and resilient rent growth. Third-quarter data confirms this trend. Reinforcing the region’s affordability, balanced population growth, and controlled new supply as key drivers of its success.

Cincinnati has particularly stood out, emerging as a leading rental market not just in the Midwest, but nationwide. In Q3 2024, Cincinnati’s rent climbed by 3.4%. This growth matches Northern New Jersey and trails only Omaha, Nebraska, which posted 4.1% rent growth.

New Supply Meets Strong Demand in Cincinnati

Over the past 12 months, Cincinnati delivered 3,500 new units, more than twice the pre-pandemic average. Despite this surge in supply, vacancy rates remain well below national levels.

- Cincinnati’s vacancy rate rose just 60 basis points year over year to 5.8%.

- National vacancy rates, by comparison, climbed 120 basis points to 7%.

The majority of these newly completed projects broke ground in early 2022, when Cincinnati’s vacancy hit a historic low of 4%. While supply has increased since then, vacancy rates remain below the ten-year market average of 6.1%, allowing landlords to sustain rent growth even as vacancies rise.

High-Performing Submarkets Fuel Growth

Certain Cincinnati submarkets continue to outperform the metro average, highlighting areas where affordability and limited supply create strong rent appreciation:

- Northwest Cincinnati: This submarket, which has seen very few completions in recent years, features a high share of affordable one-, two-, and mid-priced three-star units. Rent growth here has reached 5.7%, well above the metro average.

- Northern Kentucky: Despite an influx of new apartment deliveries over the past two years, early 2022 vacancy rates were just 3.2%—even lower than Cincinnati’s market average. While new supply has eased conditions slightly, rent growth in Northern Kentucky remains a strong 4.2%.

Why the Midwest Will Continue Outpacing National Averages

Affordability remains a key competitive advantage for Cincinnati, Omaha, Louisville, and other Midwest rental markets. Even with sustained rent growth, average asking rents in the Midwest remain well below national levels, supporting continued demand from renters priced out of higher-cost coastal and Sunbelt metros.

Looking ahead, controlled development pipelines and steady demand should enable the Midwest to maintain its lead in multifamily performance, making Midwestern markets a prime opportunity for investors seeking stable, long-term returns.