Columbus Apartment Market 2024 Now Ranks High As A Top Market for Fantastic Rent Growth Here In The States

Columbus Continues to See Strong Rent Gains

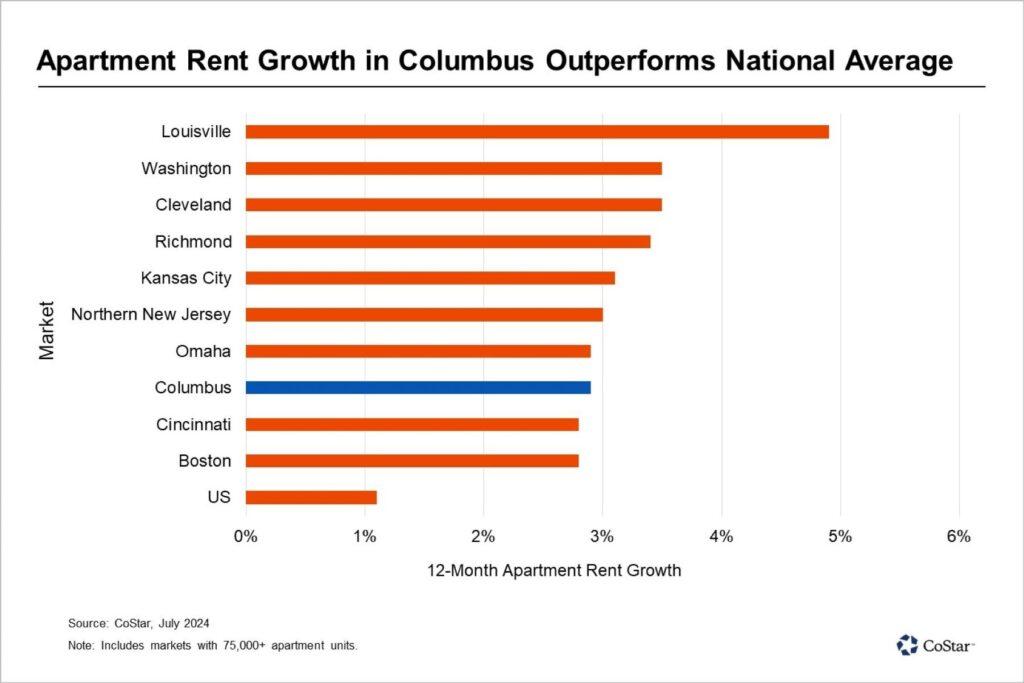

The Columbus Apartment Market 2024 is now firmly positioned among the strongest-performing rental markets in the country.

As of the second quarter of 2024, apartment rents in Columbus have risen 2.9% over the past year, ranking the city among the top 10 U.S. markets with an inventory of at least 75,000 units, according to CoStar data.

Suburban Areas Support Overall Rent Increase; Louisville Rent Growth Exceeds that of Washington DC

Unlike many larger metros experiencing oversupply and declining rents, Columbus’s balanced supply-demand dynamic continues to support rent increases, particularly in key suburban submarkets.

Columbus Apartment Market 2024: Limited Completions Keep Vacancy Low

A modest construction pipeline has played a major role in Columbus’s steady rent growth. Over the past 12 months:

- Developers completed 5,800 new units—marking a 25% increase over the five-year pre-pandemic average.

- In contrast, national apartment completions nearly doubled the pre-pandemic average during the same period.

- New unit absorption in Columbus outpaced supply, with newly occupied units increasing by 19% above the pre-pandemic average.

This controlled supply expansion has helped sustain low vacancy rates, giving landlords pricing power in most submarkets.

Suburban Areas Driving Columbus’s Rent Growth

Some of Columbus’ largest apartment hubs have seen especially strong rent growth, fueled by low vacancies and high demand:

- Northeast Columbus: Rent growth at 4.1%, with vacancy rates 150 basis points below the metro average.

- Bexley-Whitehall: Rent growth at 3.8%, with demand well above pre-pandemic levels.

Both areas have seen 12-month rental demand surpass new supply, allowing landlords to push rents without sacrificing occupancy.

Downtown Columbus Faces Temporary Weakness

Unlike its suburban counterparts, downtown Columbus has struggled to maintain rent growth. The urban core is the only submarket posting negative rent growth, largely due to:

- New apartment deliveries over the past year caused vacancy rates to rise.

- Increased competition among landlords, limiting the ability to push rents higher.

With construction activity expected to slow, downtown Columbus will likely experience renewed rent growth as rebounding demand meets fewer new deliveries.

Rent Growth in Columbus Apartment Market 2024 Expected to Continue

With persistently high interest rates limiting new construction, Columbus is expected to experience continued rent gains as supply tightens over the next 12 to 18 months. Rents in Columbus look poised to exceed pre-pandemic levels soon, driven by growth in high-demand suburban areas.

For investors, Columbus presents a stable rental market with sustained long-term demand, making it a resilient option in an evolving real estate landscape.

Click here, to learn more about our investment strategy.