Will Higher Single Family Mortgage Rates Increase Demand for Rental Housing? Data, Housing Economists Say No.

With single family mortgage rates now hovering near 7%, many multi-family investment sponsors are excitedly talking about increased demand for apartment rentals. This correlation seems logical, but in the real world it’s not that simple.

Job Growth is King

The demand fundamentals for all housing – both for sale housing and for rent housing — are driven by job growth and household formation. Strong job growth leads to increased confidence which then leads to higher rates of household formation, which ultimately leads to stronger demand for all types of housing, including rental housing.

On the other hand, during times of economic weakness and uncertainty, household formation slows. This is because consumers are unwilling to make longer term commitments in these environments. In the housing world, this means that consumers tend to either remain in place, or double up in roommate situations, or move in with their parents or other relatives until the uncertainty passes.

With the U.S. Federal Reserve tightening credit at the fastest pace in modern history and the war in Ukraine, many economists are warning of a recession in 2023. Morgan Stanley in particular is anticipating a “sharp” drop-off in employment growth, citing slower consumer demand as a trigger for hiring cutbacks “across most sectors of the economy.”

Rental Housing Demand is Slowing

Indeed, much higher single family mortgage rates have cooled the single-family housing market considerably, but rental data for August, September and October is also indicating that the Fed’s actions are creating weakness in apartment rental demand as well.

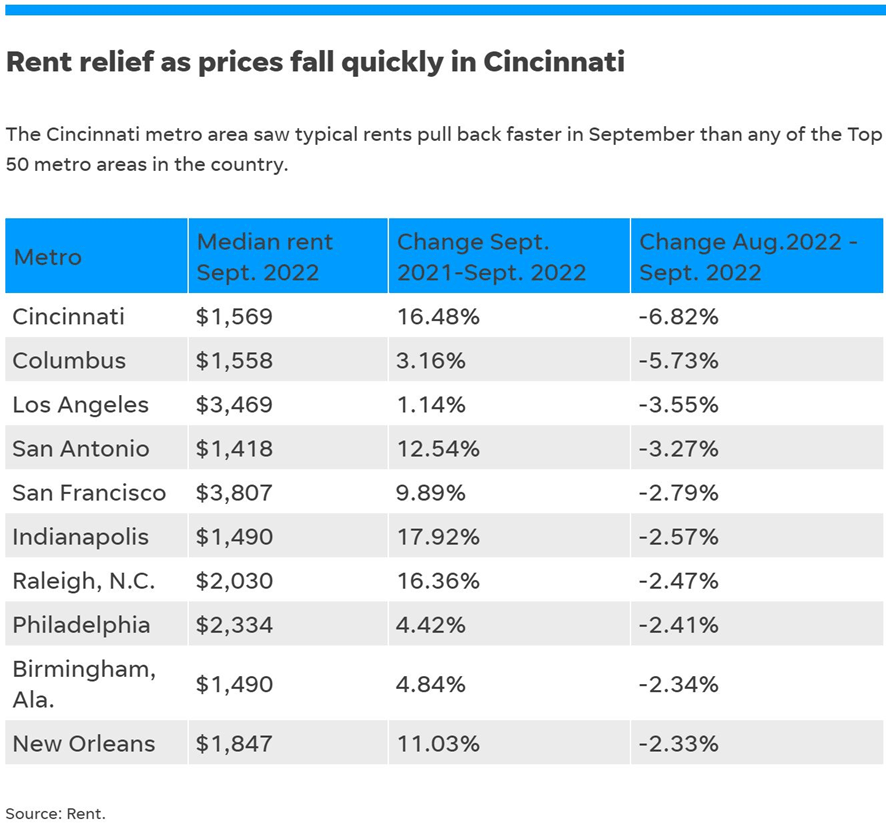

We focus on the direct investments in Midwest multifamily real estate, and Piping Rock has investments in the Cincinnati MSA. Accordingly, the market in Cincinnati is of particular relevance to us. As the below data shows, rental demand in Cincinnati was extremely robust from September 2021 to September 2022. While we are still seeing relatively strong rent growth in this market, demand did in fact cool from August 2022 to September 2022 as the Federal Reserve rate hikes took effect:

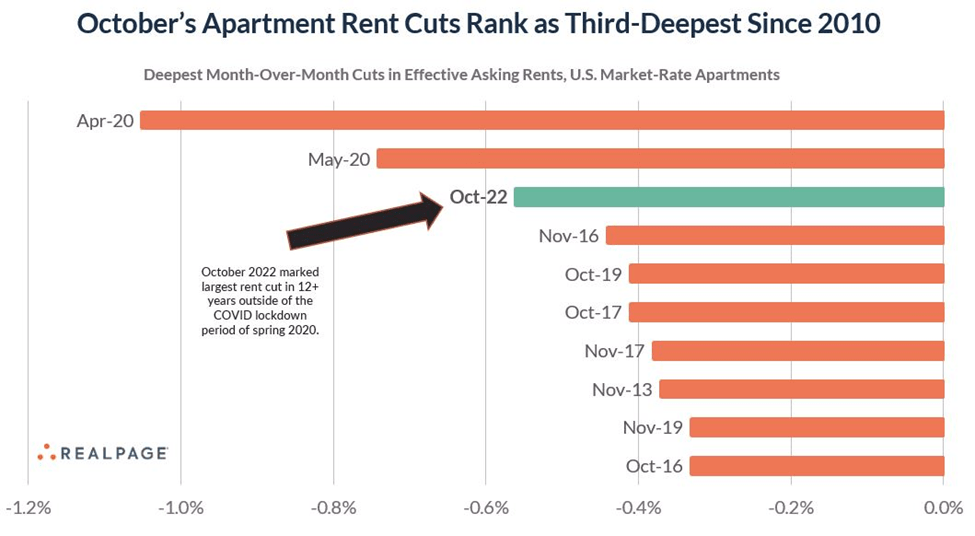

Nationally, October data from Real Page shows that apartment rent cuts in October were the third deepest since the global financial crisis in 2010:

Now, 2022 year end data is out, and this data confirmed that apartment rents dropped nationally for the third consecutive month. In addition, the data shows that rent declines in November continued the October trend with the largest decline since 2010. The only two months that posted larger declines were April and May of 2020, during the onset of the COVID pandemic.

There is an existential shortage of rental housing in the U.S., so the Fed’s interest rate increases will not cause the bottom to fall out of this market. However, the Fed’s actions are clearly not creating the demand that some non-data driven investment sponsors are claiming. Private real estate is inherently cyclical, and understanding the cycles and the associated risk is critical for successful investing. We love the cycles because they always create opportunities, but it’s important to always keep fundamentals in mind. This starts with the ability to distinguish true drivers of demand.